Mortgage rates have been trending lower in anticipation of the Federal Reserve nearing the end of its interest rate hiking campaign to rein in inflation. QUICK TOOLS > Home > Mortgage Loan Program > Mortgage Calculator > Cities > About Us > Contact Us Cal Mortgage Rates and Gold Eagle Capital is not a direct lender.

They're getting a lot of attention from buyers."Įven with elevated home prices, experts say lower mortgage rates should help ease the affordability squeeze for millions of Americans. 275 E Hillcrest Drive Suite 160-1008 Thousand Oaks, CA 91360. "Bidding wars are still happening for properties that are priced right and have that HDTV, turn-key look. Today’s mortgage rates in Oklahoma are 7.459 for a 30-year fixed, 6.467 for a 15-year fixed, and 8.080 for a 5-year adjustable-rate mortgage (ARM). Our objective is to ensure that you receive the greatest loan possible, so we developed tools to help you enhance your loan request and boost your chances of receiving a better loan for real estate business. "Until we see more inventory, I don't see how prices come down," said Nagle. If you’re in a hurry to secure hard money loans Los Angeles, we’ll match you with top subprime or prime lenders. "Interest rates in the 5% to 6% range aren't enough to offset the bigger problem of limited supply," Richard Nagle, a real estate agent with RE-MAX Elite in Monmouth Beach, New Jersey, told ABC News. That's the smallest decrease in almost three months, but much steeper than the 8% decline a year ago. New listings fell 18% year over year during the four weeks ending Jan. What's more, fewer sellers are putting homes on the market, adding to the supply crunch. New home construction fell 1.4% in December compared to November and was down nearly 22% from a year ago, according to the Census Bureau. All posted interest rates are in effect on the date listed: All rates shown are subject to change without notice.CalHFA does not lend money directly to consumers. At the end of December, total housing inventory was below one million at 970,000, down 13.4% from November with just a 2.9 month supply on the market, according to the National Association of Realtors. As of Monday, September 18, 2023, current interest rates in California are 7.63 for a 30-year fixed mortgage and 6.73 for a 15-year fixed mortgage. household, according to Robert Dietz, chief economist at the National Association of Home Builders.Įven though homebuyer demand is improving, the number of available homes for sale is still very low, and that is keeping upward pressure on prices.

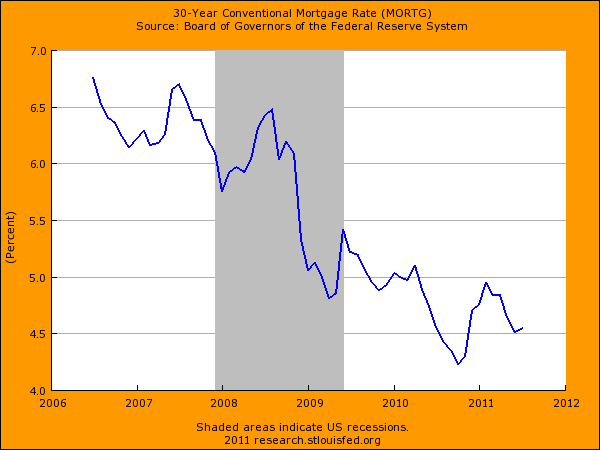

Just 42% of new and existing homes for sale in January were considered affordable for the typical U.S. The median listing price in January was $400,000, according to, roughly 8.1% higher than a year ago, but still lower than June's peak of $449,000. The current national average 5-year ARM mortgage rate is down 10 basis points from 7.21 to 7.11. Additionally, the current national average 15-year fixed mortgage rate decreased 2 basis points from 6.32 to 6.30. A home's price can just as easily push a buyer out of the market. The 30-year fixed mortgage rate on Septemis up 4 basis points from the previous week's average rate of 7.01.

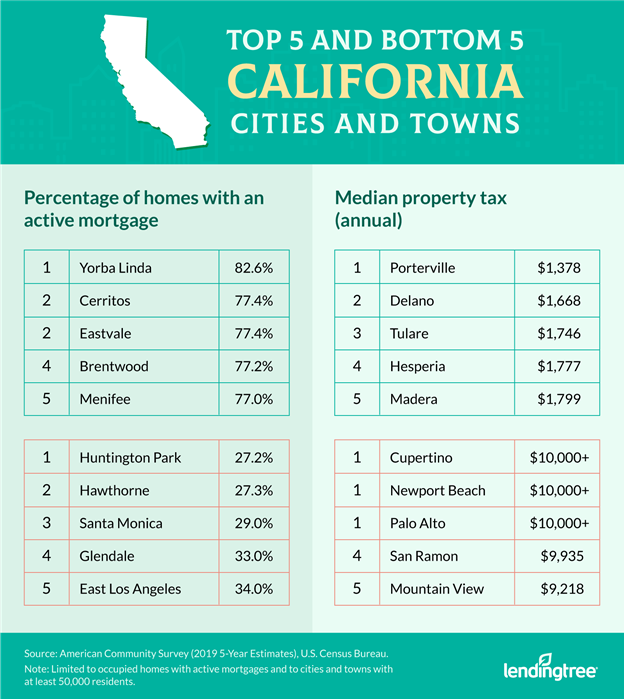

Of course, mortgage rates are only part of the equation. Nevertheless, pockets of affordability do exist outside the states major cities, and mortgages with reasonable interest rates can be found without a high.

0 kommentar(er)

0 kommentar(er)